From 2010-2018, Theranos raised $724M in funding.

While Elizabeth Holmes was selling fake blood tests and preventing journalists from actually looking at her company, other legitimate companies with real results went bankrupt.

Holmes knew her tests and methods weren’t special. They used conventional machines from other companies for 95% of tests. Created fake labs for investor tours. Employees testified that management ignored accuracy problems. Even the internal emails showed awareness that Edison machines were unreliable.

But what made her attractive to investors was the story she built around it.

Holmes engineered a narrative that made it impossible for Silicon Valley investors to ignore.

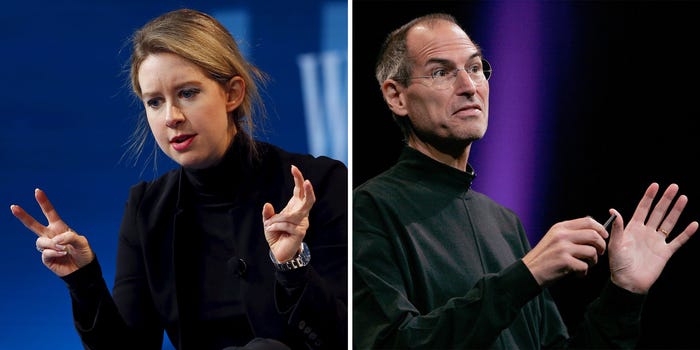

Steve Jobs Cosplay Beats Scientific Credentials

Holmes built her narrative around Steve Jobs, even copying his signature black turtleneck look and presentation style.

She further claimed her simple blood tests could revolutionize healthcare by providing early tests for 100s of diseases. Her Edison machines were positioned as empowering patients, reducing pain and anxiety, and catching diseases earlier. It was a moral imperative to invest in her work.

She copied the Steve Jobs & Apple Narrative:

Called Theranos devices “the iPod of healthcare”

Used the same advertising agency Chiat\Day as Apple.

Even borrowing management techniques from Jobs written in his biography.

Theranos employees said they "could pinpoint which chapter she was on based on which period of Jobs’s career she was impersonating."

From its founding in 2003 to 2014, when Theranos’s reputation started cracking, the company peaked at a $10 billion valuation.

She understood Jobs’s appeal was in the message and presentation. Holmes understood something about Silicon Valley that legitimate founders miss VCs fund stories about technology.

VCs Choose Narrative Over Evidence Every Time

For Silicon Valley, disruption is their philosophy.

They fully embrace “creative destruction” where new technologies destroy old industries and pave ways for new ones. They’re focused on buzzwords and changing the landscape rather than real results.

It’s a hunt for unicorns. A gamble. Hoping to win big.

Even the popular startup book “Measure what Matters” by John Doerr is filled with quotes backed by their disruption philosophy.

“If companies don't continue to innovate, they're going to die— and I didn't say iterate, I said innovate.”

— John Doerr, Measure What Matters

Holmes built the narrative by recruiting authority whose presence and brand overshadowed her actual expertise

Two Medical Experts vs. Ten Politicians: The Board That Fooled Everyone

Late-Stage Venture Capitalists invested in Theranos based on hype.

Theranos’s board had high-profile names:

George Shultz – Former US Secretary of State

Henry Kissinger – Former US Secretary of State

William Perry – Former US Secretary of Defense

Sam Nunn – Former US Senator and chairman of the Senate Armed Services Committee

James Mattis – Retired US Marine Corps General (later US Secretary of Defense)

Gary Roughead – Retired US Navy Admiral

Richard Kovacevich – Former CEO and Chairman of Wells Fargo

Riley P. Bechtel – Chairman and former CEO of Bechtel Group

William H. Frist – Former US Senator, heart and lung transplant surgeon

William H. Foege – Former Director of the CDC

Sunny Balwani – President and COO of Theranos

Elizabeth Holmes – Founder, CEO, and Chairman

Only Frist (even though he wasn’t practicing at the time) & Foege had actual medical experience. The rest had the brand presence to get eyeballs on the company.

It was an appeal to authority bias. If these people are on the board, then the company must be legit.

The late-stage VCs were spellbound by the narrative. They relied on other people’s vetting instead of independently verifying business fundamentals or technology claims for themselves.

Holmes understood investor psychology and used it.

While investors were mesmerized by Kissinger and Mattis, companies with actual medical credentials were dying. The theft was opportunity.

Real Companies Died While Theranos Raised $724M

While the hype around Theranos continued, legitimate medical tech companies were struggling to get funding and attention.

Claritas Genomics~$15 million (est.)

A Pediatric genetic diagnostic company spun out of Boston Children’s Hospital.

They were CLIA-certified, NY State approved, had a strong clinical network, and focused on rare diseases.

Shutdown in January 2018 due to misalignment among investors, inability to secure sufficient reimbursement, and payer resistance to covering genetic tests despite high clinical quality.

14M Genomics: Limited Series A (exact amount not public)

Focus on precision oncology diagnostics, cancer genomics, and personalized medicine. They had strong clinical partnership but were unable to scale or attract enough VC funding.

They shut down in 2016.

Since the Theranos scandal hit the headlines there have been numerous reports of diagnostics startups finding it harder to convince investors to part with their cash. In 2021, the chief scientific officer of a US-based biotech told the Guardian that ‘healthy scepticism [of diagnostics technology] had evolved into complete mistrust

The damage continues today.

Every AI wrapper that raises $50M makes it harder for real machine learning research to get funded. So how do legitimate founders fight back?

Transparency Is Your Only Weapon Against Fraud

Each phony-science startup destroys trust for any real science company. The hype overpowers any result and innovation. We saw it with Theranos and currently see with AI tools today where more are just “AI-wrappers” that call OpenAI’s API while actual machine learning research starves.

How can legitimate med tech startups fight the hype?

Have actual professionals relevant to your industry on your board.

The problem wasn’t that Holmes had big names on her board, it was that she had 2 medical professionals, one who wasn’t even practicing.

Demand Transparency in methods and results.

When a Vox reporter tried interviewing Holmes and seeing her blood tests, she was pushed around and actively prevented from seeing real tests and speaking with Holmes. Someone even pulled the fire alarm to cancel the interview.

The PR tactics Theranos employed blocked journalists from providing the kind of scrutiny that might have revealed the fantasy the company was weaving for investors sooner.

How Theranos hid its sketchiness from reporters — and helped keep the puff pieces coming | Vox

Require Independent Validation.

When we encounter new technology and companies, we need to verify using external parties. Encourage publication of peer-reviewed clinical and technical data and make it accessible to both investors and the public

These tactics help, but they miss the deeper truth.

The entire game has changed. Science founders who think good research will speak for itself are bringing knives to a psychological warfare fight.

Good Science Isn't Enough. We Need Better Psychology

Phony science companies like Theranos are destructive.

And it’s not new thing. Phony science companies have been around as long as the snake oil salesman. But Theranos capitalized on investor psychology and used it to gain funding.

If you're building real technology, you can stick to the science and hope the results speak for themselves or allow other fraudsters to take the attention and money and get ahead.

You're not just competing against other startups. You're competing against founders who've studied investor psychology better than you've studied science. What are you going to do about it?